Moving your business to the top with us

Hi Daljinder.

On your personal client page, you can upload documents, and we've created an Academy with the most important information and much more about your business.

On your personal client page, you can upload documents, and we've created an Academy with the most important information and much more about your business.

Don´t miss out! Get the Nextcloud App now!

Switch today and enjoy secure, GDPR-compliant cloud storage, built for your business privacy*

*one-time needed -> servername: cloud.consalt.pt

*one-time needed -> servername: cloud.consalt.pt

IMPORTANT DATES

Below is an overview of the key annual tax deadlines in Portugal. Please review and note these dates to ensure compliance.

- SAF-T ExportWe require the SAF-T file to be submitted to us by the 5th of each month to ensure timely processing and compliance with legal requirements.

- Social SecurityThe social security contributions must be paid by the 20th of each month to avoid penalties and ensure compliance.

- VAT ReturnVAT payments must be made by the 25th of each month. If a credit balance exists, it will be automatically refunded within 60 days.

- Annual Financial StatementsMust be prepared and submitted between January ans May to comply with Portuguese regulations.

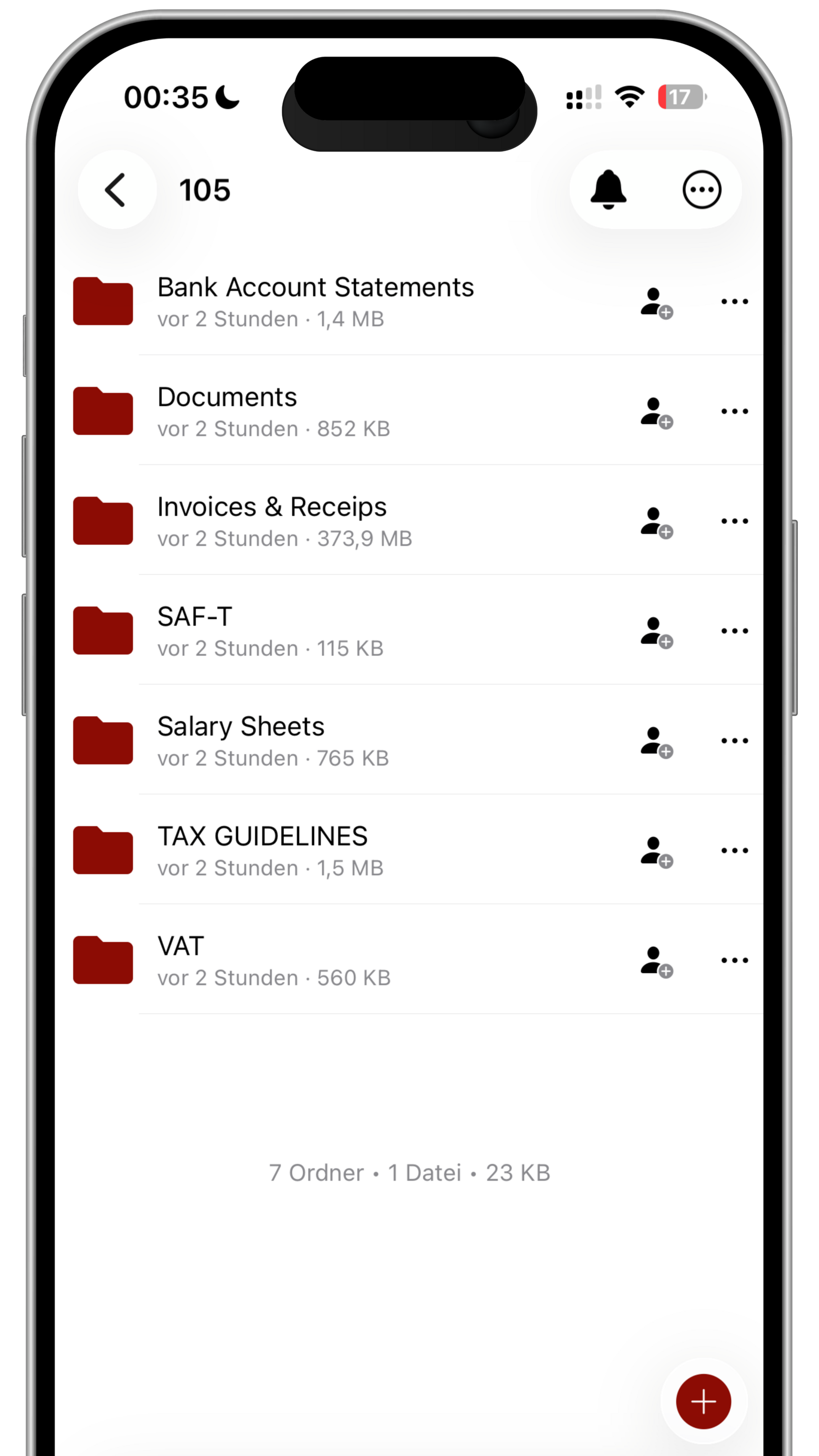

YOUR DOWNLOAD AREA

Download annual reports, quarterly figures, salary sheets, and more directly using the button below.

YOUR TAXADEMY

Get all the essential insights on Portuguese taxes and solutions for common issues at our Taxademy platform.

Your Feedback is Valuable!

Did you enjoy our service?

Leave us a Google Review and help others find us.

Your feedback makes a difference! ⭐⭐⭐⭐⭐

Leave us a Google Review and help others find us.

Your feedback makes a difference! ⭐⭐⭐⭐⭐

OUR CONTACTS

We want to make friends with our clients, so we are happy to answer your questions.

+351 911 919 143

clientes@consalt.pt

clientes@consalt.pt

Rotunda Engº Edgar Cardoso 23 - 12ºC

4400-676 Vila Nova de Gaia

4400-676 Vila Nova de Gaia